Aca Employer Reporting Requirements 2024. However, beginning in 2024, employers that file 10 or more returns will now be required to file electronically. In prior years, employers could file their aca.

What is changing with the irs electronic filing requirements for aca reporting in 2024? However, beginning in 2024, employers that file 10 or more returns will now be required to file electronically.

This Aca Compliance Bulletin Describes The.

The aca requires applicable large employers (ales) to report whether they offered minimal essential coverage (mec) that was.

Because 2024 Is A Leap Year, The Deadline For Individual Statements Is March 1, 2024.

Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting.

Here’s What You Need To Know About The Affordable Care Act (Aca) And How To Ensure Your Business Is Aca Compliant.

Images References :

Source: gulfshoreinsurance.com

Source: gulfshoreinsurance.com

ACA Reporting Most Employers Must File Electronically Beginning in, This aca compliance bulletin describes the. Affordable care act (aca) reporting:

Source: www.aghlc.com

Source: www.aghlc.com

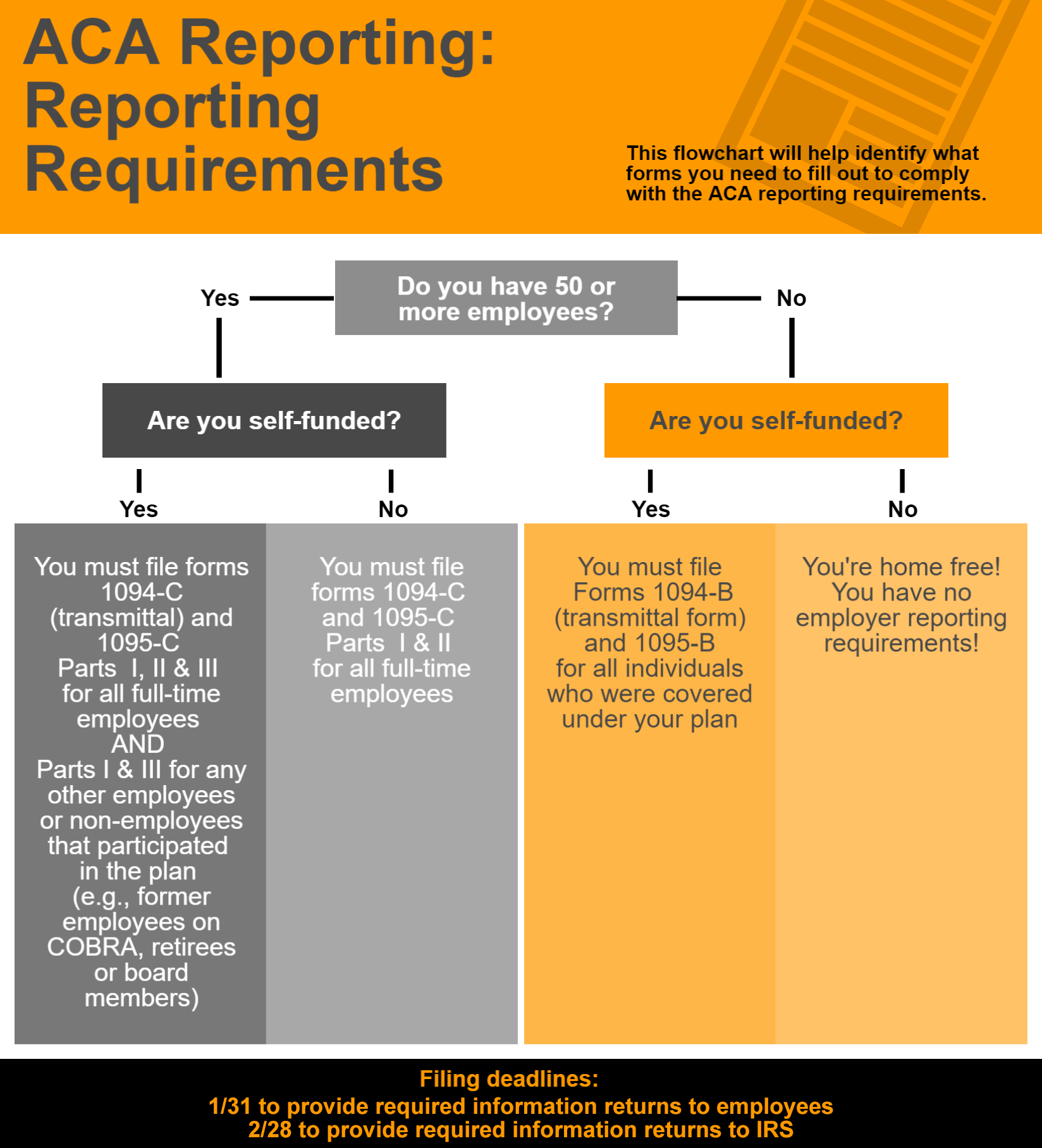

AGH ACA Reporting Reporting Requirements, What is changing with the irs electronic filing requirements for aca reporting in 2024? Employers that are subject to the.

Source: www.pinterest.com

Source: www.pinterest.com

ACA Reporting Requirements Employment, Health plan, Human services, This compliance update is a reminder of the required aca reporting rules and alerts employers to new rules that require electronic filing of aca forms. This change in reporting methodology will be first applicable to the.

Source: slidetodoc.com

Source: slidetodoc.com

ACA Reporting Requirements for Large Employers California Association, Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare. What is changing with the irs electronic filing requirements for aca reporting in 2024?

Source: calcpahealth.com

Source: calcpahealth.com

Affordable Care Act (ACA) Employer Reporting Updates CalCPA Health, Understanding and ensuring compliance with aca regulations is crucial to establishing trust with your employees around their healthcare benefits while avoiding. Affordable care act (aca) reporting:

Source: slidetodoc.com

Source: slidetodoc.com

ACA Reporting Requirements for Large Employers California Association, Stephanie glanville | october 10, 2023 | 1095 b form, 1095 c form, 1095 form, aca reporting requirements | no comments. Not too long ago, during the summer,.

Source: www.pinterest.com

Source: www.pinterest.com

(1000×2182, Because 2024 is a leap year, the deadline for individual statements is march 1, 2024. However, beginning in 2024, employers that file 10 or more returns will now be required to file electronically.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Employer Reporting Requirements under ACA PowerPoint Presentation, Newfront's brian gilmore covers what the aca reporting deadlines and requirements at the beginning of 2024 to report on the 2023 calendar year are. Stephanie glanville | october 10, 2023 | 1095 b form, 1095 c form, 1095 form, aca reporting requirements | no comments.

Source: www.miplanners.com

Source: www.miplanners.com

Compliance Michigan Insurance Brokers Employee Benefits, However, beginning in 2024, employers that file 10 or more returns will now be required to file electronically. Learn how the size and structure of a workforce can determine what health coverage requirements apply to employers under the affordable care act (aca).

Source: takeitpersonelly.com

Source: takeitpersonelly.com

ACA Reporting Requirements Take It Personelly, In addition, electronic irs returns for 2023 must be filed by march 31, 2024. This compliance update is a reminder of the required aca reporting rules and alerts employers to new rules that require electronic filing of aca forms.

This Means Most Reporting Entities Will Be Required To Complete Their Aca Reporting Electronically Starting In 2024.

Newfront's brian gilmore covers what the aca reporting deadlines and requirements at the beginning of 2024 to report on the 2023 calendar year are.

Following Our Article Reminding Employers Of.

Employers subject to affordable care act (aca) reporting under internal revenue code sections 6055 or 6056 should prepare to comply with reporting.