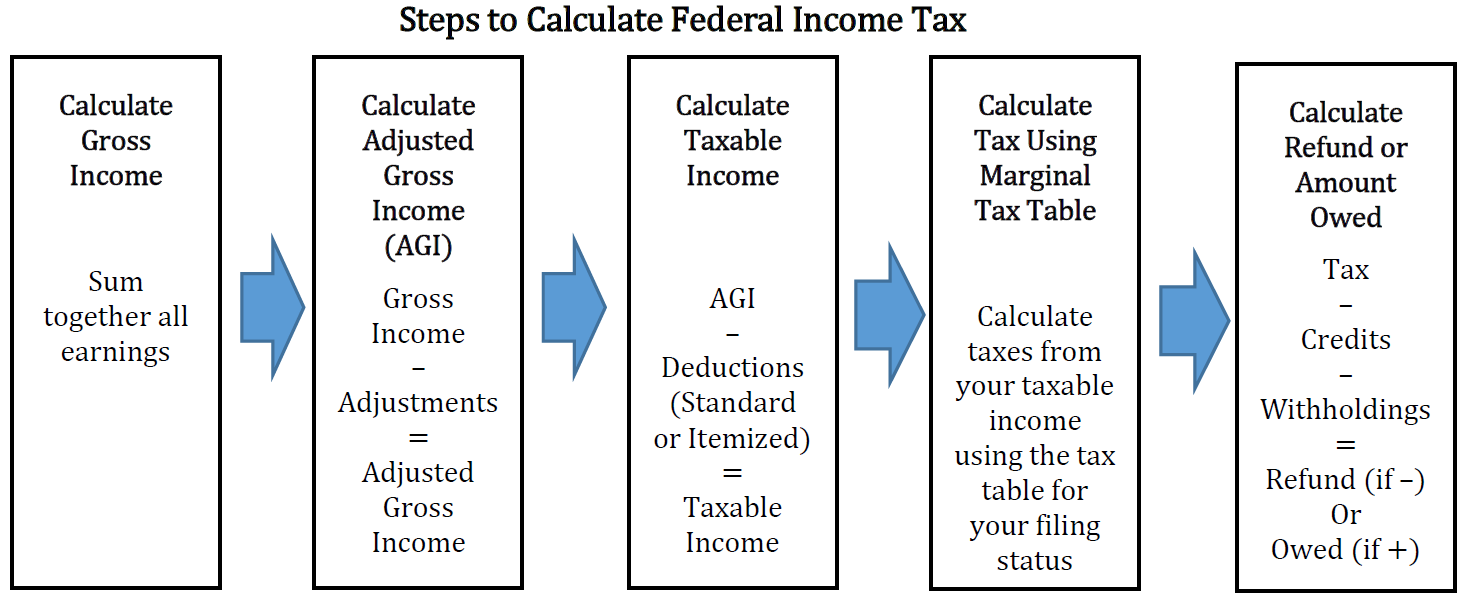

Calculating Federal Income Tax 2025. Here's a breakdown of the income tax brackets for 2023, which you will file in 2025: How to calculate net income.

How to calculate your federal income tax bracket. You can calculate your taxes by dividing your income into the portions that will be taxed in each applicable.

For Reference, The Top Federal Income Tax Rate Is 37%, And The Bottom Rate Is 10%.

How to calculate federal tax based on your annual income.

Once Your Income Progresses To Its Highest Tax Bracket—22% In This Example—You’ve Hit Your Marginal Tax Rate.

Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2025.

Calculate Your Federal, State And Local Taxes.

Images References :

Source: spot.pcc.edu

Source: spot.pcc.edu

Taxes, Here's a breakdown of the income tax brackets for 2023, which you will file in 2025: Estimate your tax refund or how much you may owe the irs with taxcaster tax calculator.

Source: www.chegg.com

Source: www.chegg.com

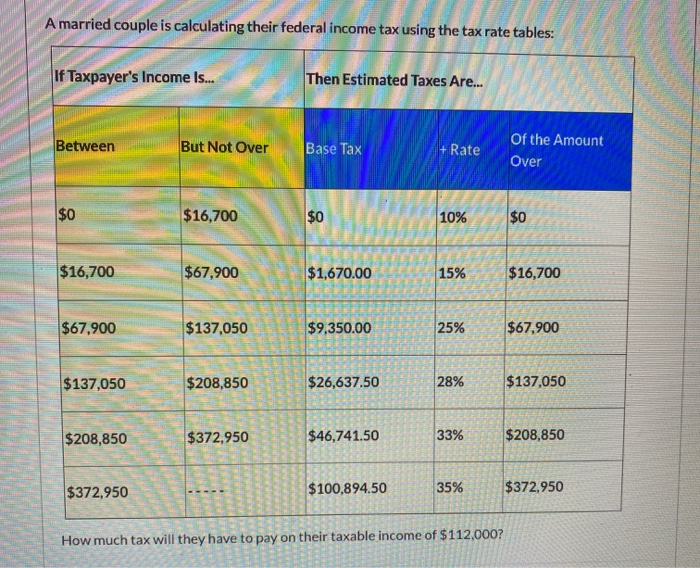

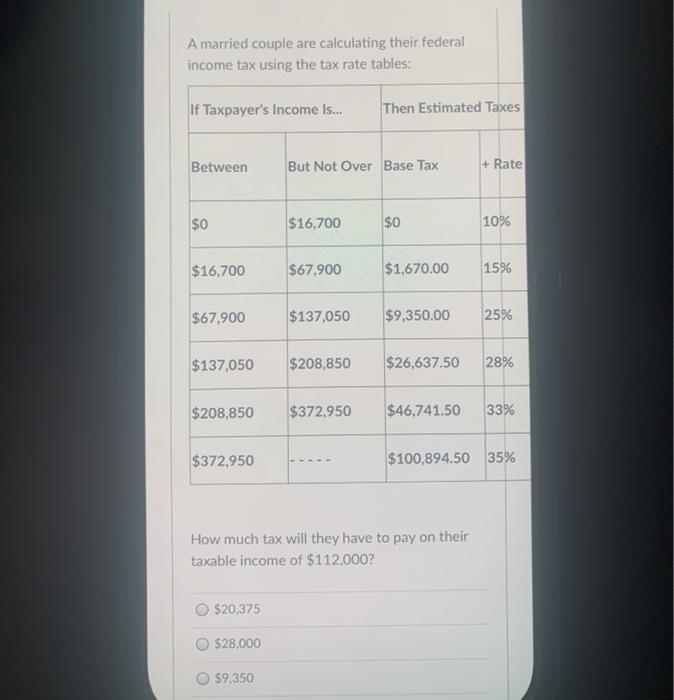

Solved A married couple is calculating their federal, Enter your income and location to estimate your tax burden. 2025 federal/state income tax, fica, state payroll tax, federal/state standard deduction, exemptions & local income taxes

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

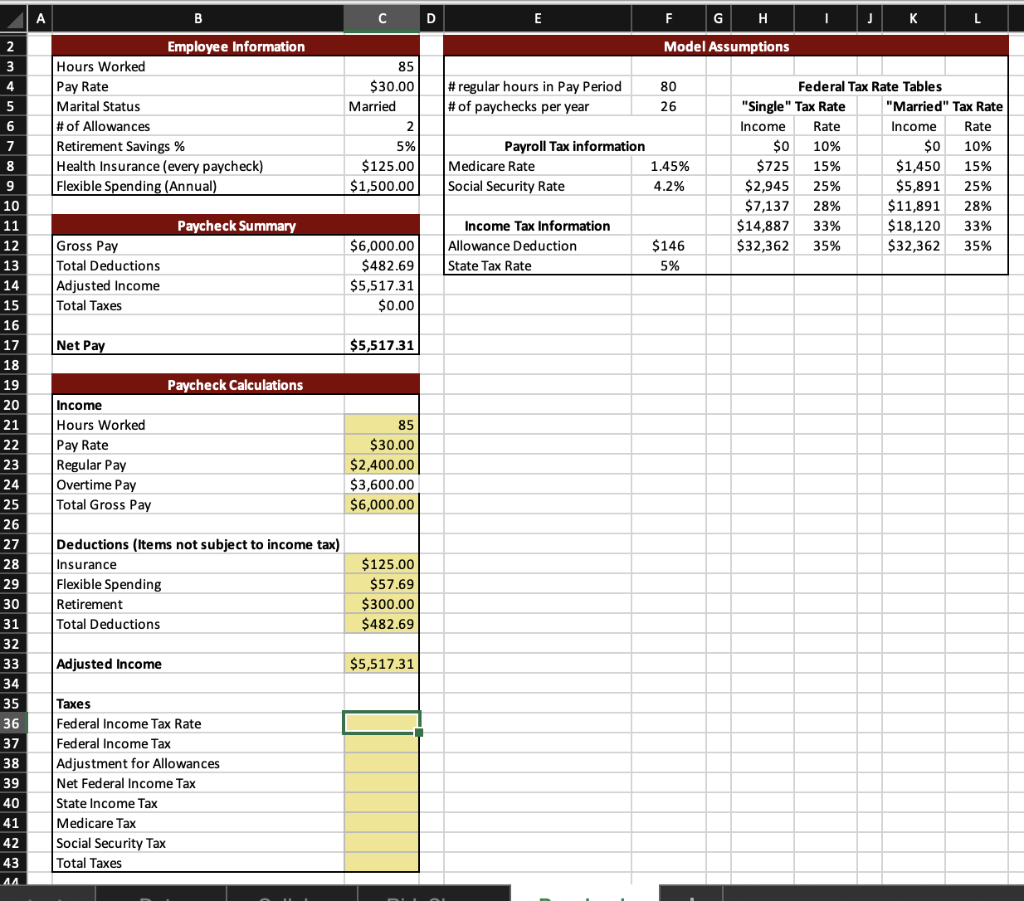

How to calculate payroll taxes 2021 QuickBooks, Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2025. Federal income tax is usually the largest tax deduction from gross.

Calculating federal tax per pay period GracieMaeAmi, For reference, the top federal income tax rate is 37%, and the bottom rate is 10%. How to calculate net income.

Source: www.chegg.com

Source: www.chegg.com

Solved Use an IF function to calculate the Federal, Here's a breakdown of the income tax brackets for 2023, which you will file in 2025: You can use our income tax calculator to estimate how much you’ll owe or whether you’ll qualify for a refund.

Source: www.chegg.com

Source: www.chegg.com

Solved A married couple are calculating their federal, Federal income tax is usually the largest tax deduction from gross. Estimate your tax refund or how much you may owe the irs with taxcaster tax calculator.

Federal Withholding Tax Table Matttroy, You can use our income tax calculator to estimate how much you’ll owe or whether you’ll qualify for a refund. Updated on apr 24 2025.

Source: taxwithholdingestimator.com

Source: taxwithholdingestimator.com

Federal Tax Calculator 2021 Tax Withholding Estimator 2021, Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. / updated february 01, 2025.

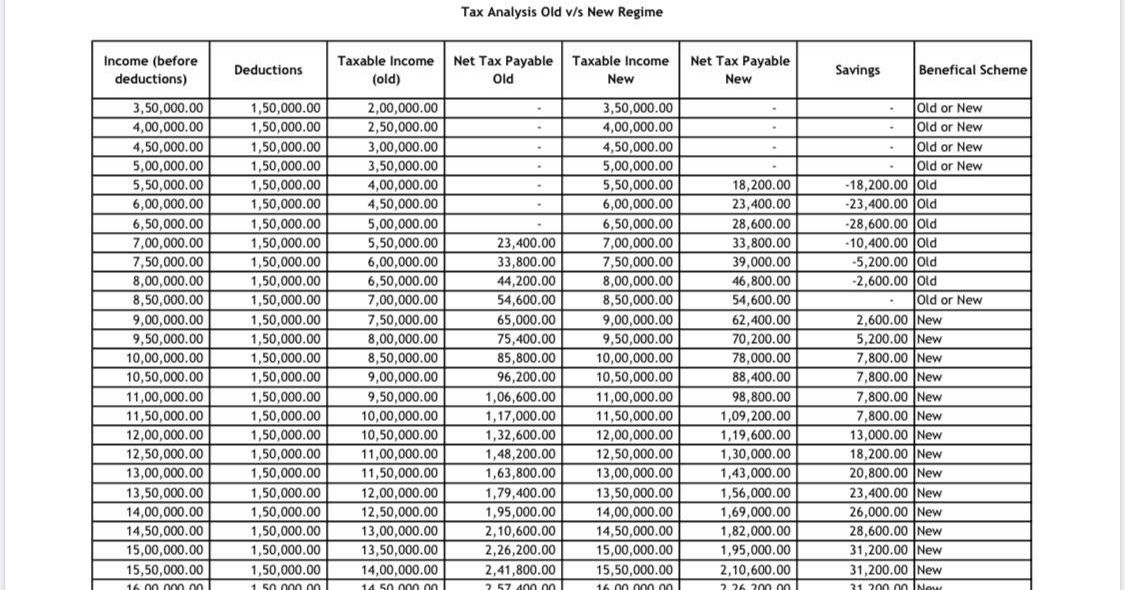

Source: www.educba.com

Source: www.educba.com

Taxable Formula Calculator (Examples with Excel Template), 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Federal income tax is usually the largest tax deduction from gross.

Source: www.taxablesocialsecurity.com

Source: www.taxablesocialsecurity.com

Calculate Taxable Social Security Benefits 2023, For reference, the top federal income tax rate is 37%, and the bottom rate is 10%. In 2025, the federal income tax rate tops out at 37%.

Only The Highest Earners Are Subject To This Percentage.

You can calculate your taxes by dividing your income into the portions that will be taxed in each applicable.

For The 2025 Tax Year, The Adjusted Gross Income (Agi) Amount For Joint Filers To Determine The Reduction In The Lifetime Learning Credit Is $160,000;

How to calculate your federal income tax bracket.